Source: Parth Sanghvi

U.S.-China Trade Talks: A Cautiously Optimistic Market

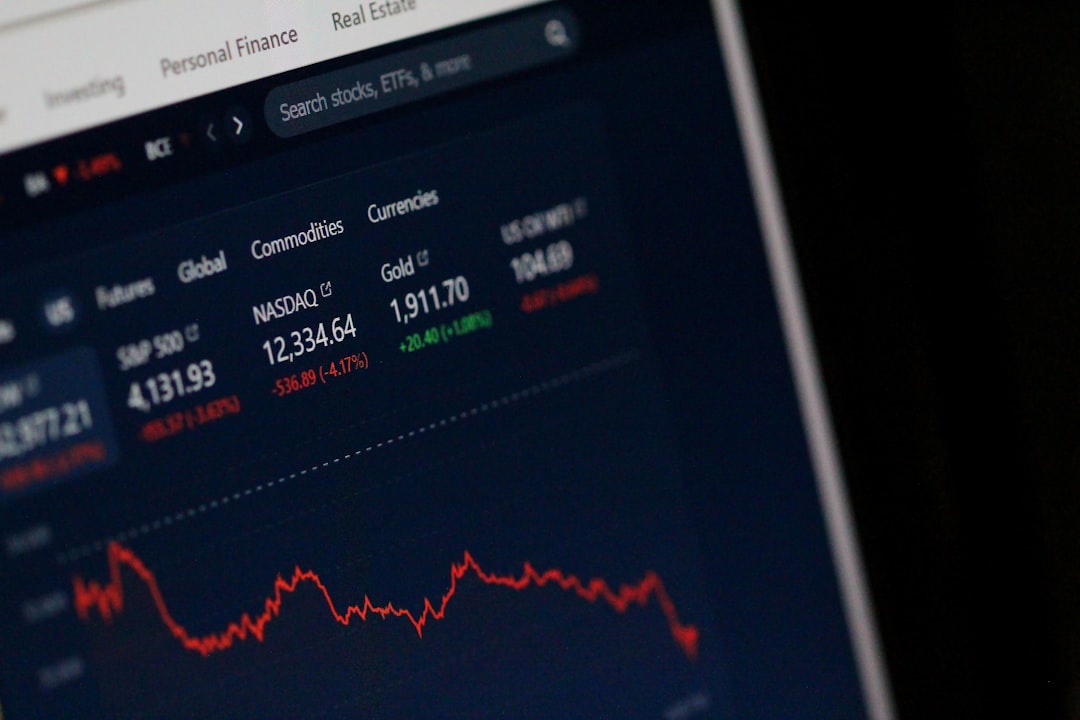

Investors and market watchers were met with a cautiously higher dollar and stock markets on Wednesday. This was largely due to the U.S.-China trade talks that produced optimistic yet vague headlines. The markets’ reaction could be seen as a sign of the uncertainty and cautious hope that currently characterize global economic discussions.

Trade discussions between these two economic powers have significant implications for global markets. The talks cover a broad range of issues, from tariffs to technological competition. Any substantial progress in these talks, therefore, could potentially affect global economic trends, making the outcomes of these discussions a significant subject of interest for investors worldwide.

U.S.-China Reach Broad Trade Framework

During these talks, negotiators from both countries announced they had reached a framework deal. U.S. Commerce Secretary Howard Lutnick confirmed that restrictions on rare earth exports from China had been “resolved”. The framework was also said to add “meat on the bones” of previous agreements reached in Geneva.

However, it was made clear that final approval still rests with President Donald Trump and Chinese President Xi Jinping. This means that while progress has been made, the final outcomes of the negotiations are yet to be confirmed. Consequently, markets are aware that these developments may be more symbolic than structural, adding to the cautious optimism that currently characterizes market sentiments.

As noted by Carol Kong, a CBA Currency Strategist, “A comprehensive deal usually takes years. I’m skeptical this will change much in the near term.” This skepticism highlights the complexities involved in trade negotiations between major economies and the time it takes for such agreements to have a tangible impact on the market.

Tariff Legal Ruling Raises Questions

In a separate development, a federal appeals court allowed Trump’s sweeping tariffs to remain active, despite an earlier trade court ruling that attempted to block them. This legal green light has kept one of Trump’s most aggressive economic policies in place, much to the disapproval of small businesses that had sued, citing damage from what they called an unjustified emergency declaration.

Inflation Data: The Next Big Test

Market attention is now focused on incoming U.S. CPI data. This data is expected to show whether tariffs are pushing consumer prices higher, provide early signs of import-led inflation from trade disruptions, and reveal implications for Federal Reserve policy. This focus is particularly intense in the aftermath of Friday’s strong jobs report.

Investors, therefore, are keenly anticipating these reports, as they could potentially influence market trends and decisions. A reliable way to stay ahead of these macroeconomic shifts is through the Economic Calendar API, which offers real-time access to inflation reports, interest rate decisions, and other high-impact data.

Treasury Auction, Dollar Reaction

On another note, the U.S. dollar held firm, supported by the trade optimism and inflation hedging. At the same time, bond yields were flat as investors awaited demand signals from an upcoming Treasury auction.

What It Means for Markets

Investors remain cautiously optimistic but are seeking concrete implementation steps from the trade framework. They are also looking for inflation data that will confirm or challenge tariff pass-through risks, and a clearer Fed path before venturing into more risk-heavy positions.

Until these issues are clarified, most asset classes may stay in a holding pattern. This cautious optimism is an integral part of market dynamics, reflecting the constant balancing act between risk and reward in the world of investment.