Source: davit kirakosyan

Airbnb’s Q3 Earnings Report: The Highlights

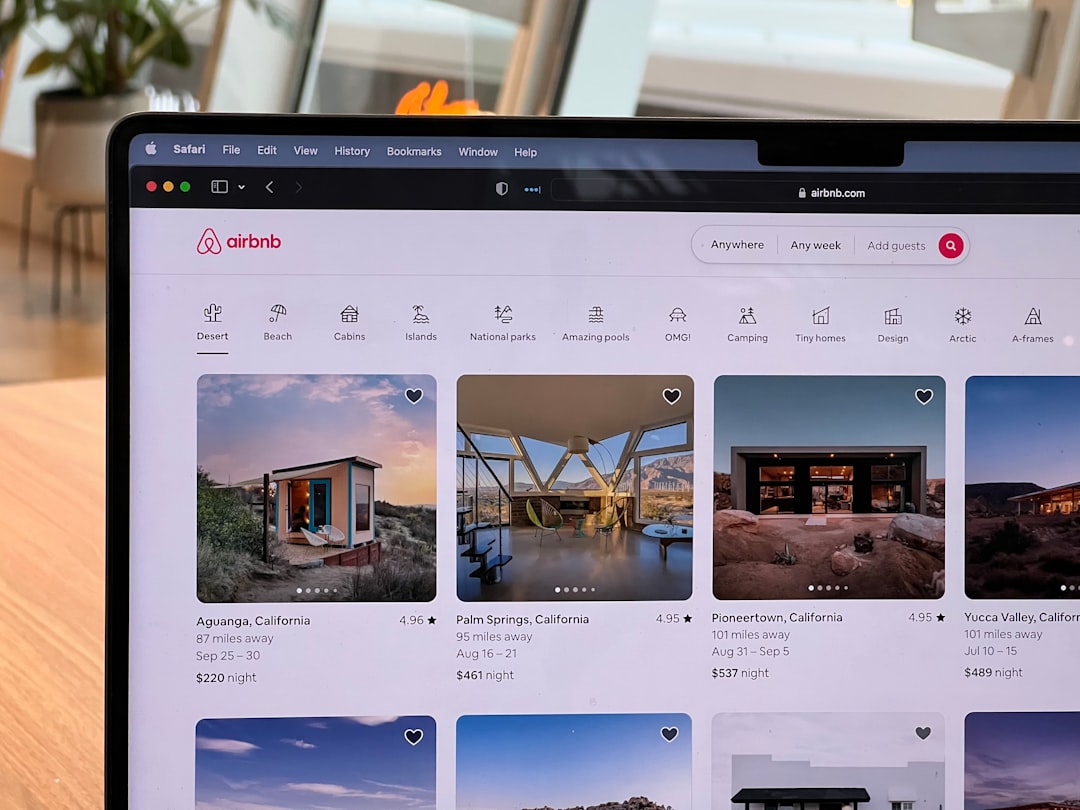

Airbnb Inc. (NASDAQ: ABNB), a home-sharing platform that has transformed the way people travel, recently released its third-quarter earnings report. The results missed Wall Street expectations due to increased investment spending, but the company offered an optimistic forecast for the fourth quarter, based on strengthening travel demand and a rise in long-term bookings.

The company reported earnings of $2.21 per share on revenue of $4.1 billion, falling short of analyst expectations which predicted $2.31 per share on revenue of $4.08 billion. The company’s adjusted EBITDA margin fell to 50%, down from 52% from the same period last year.

A Closer Look at Airbnb’s Performance

Despite the earnings miss, there were bright spots in Airbnb’s report. The company saw a 14% increase in gross booking value, a key indicator of the company’s performance, compared to the same period in the previous year. This suggests that even amid economic uncertainties, the home-sharing business continues to hold its own, with more people turning to Airbnb for their travel accommodation needs.

In addition, Airbnb’s nights and seats booked saw a rise of 9%. This is an encouraging sign, as it indicates that guests are not just booking more stays, but also staying for longer periods, which is crucial for Airbnb’s bottom line. The increase in longer-term bookings reflects a broader shift in the way people are now traveling – taking longer trips and often working remotely from their Airbnb rentals.

Airbnb’s Forecast for Q4 and Beyond

Looking ahead, Airbnb’s outlook for the fourth quarter is promising. The company is projecting revenue to be in the range of $2.66 billion to $2.72 billion, which represents year-over-year growth of 7% to 10%. This projection surpasses the consensus estimates of $2.67 billion. Additionally, the company expects its gross booking value for the quarter to rise at a low double-digit pace, signaling continued growth and resilience in the travel sector.

For the full year of 2025, Airbnb is forecasting a rise in its adjusted EBITDA margin to about 35%, up from its previous forecast of at least 34.5%. This expected rise in margin reflects Airbnb’s ongoing efforts to streamline its operations and improve profitability.

Analysing Airbnb’s Position in the Market

These results come at a time when the global travel industry is gradually recovering from the impacts of the COVID-19 pandemic. Despite the lower-than-expected Q3 earnings, Airbnb’s bullish Q4 forecast is a testament to its strong position in the market, and it’s adaptability in the face of changing travel trends.

The boost in long-term bookings, in particular, is a trend that Airbnb has capitalized on during the pandemic. As more people adopt remote work arrangements, the demand for flexible and extended stays has increased, and Airbnb has been able to cater to this new form of ‘digital nomad’ lifestyle.

In summary, while Airbnb’s Q3 earnings fell short of Wall Street forecasts, its performance in terms of gross booking value, nights and seats booked, and its optimistic Q4 projection, all indicate a company that is weathering the challenges and evolving with the changing dynamics of the travel industry. The focus now shifts to the final quarter results, which could further underline Airbnb’s resilience in a post-pandemic world.