Source: Rayan Ahmad

A Look at Futu Holdings Limited Sponsored ADR

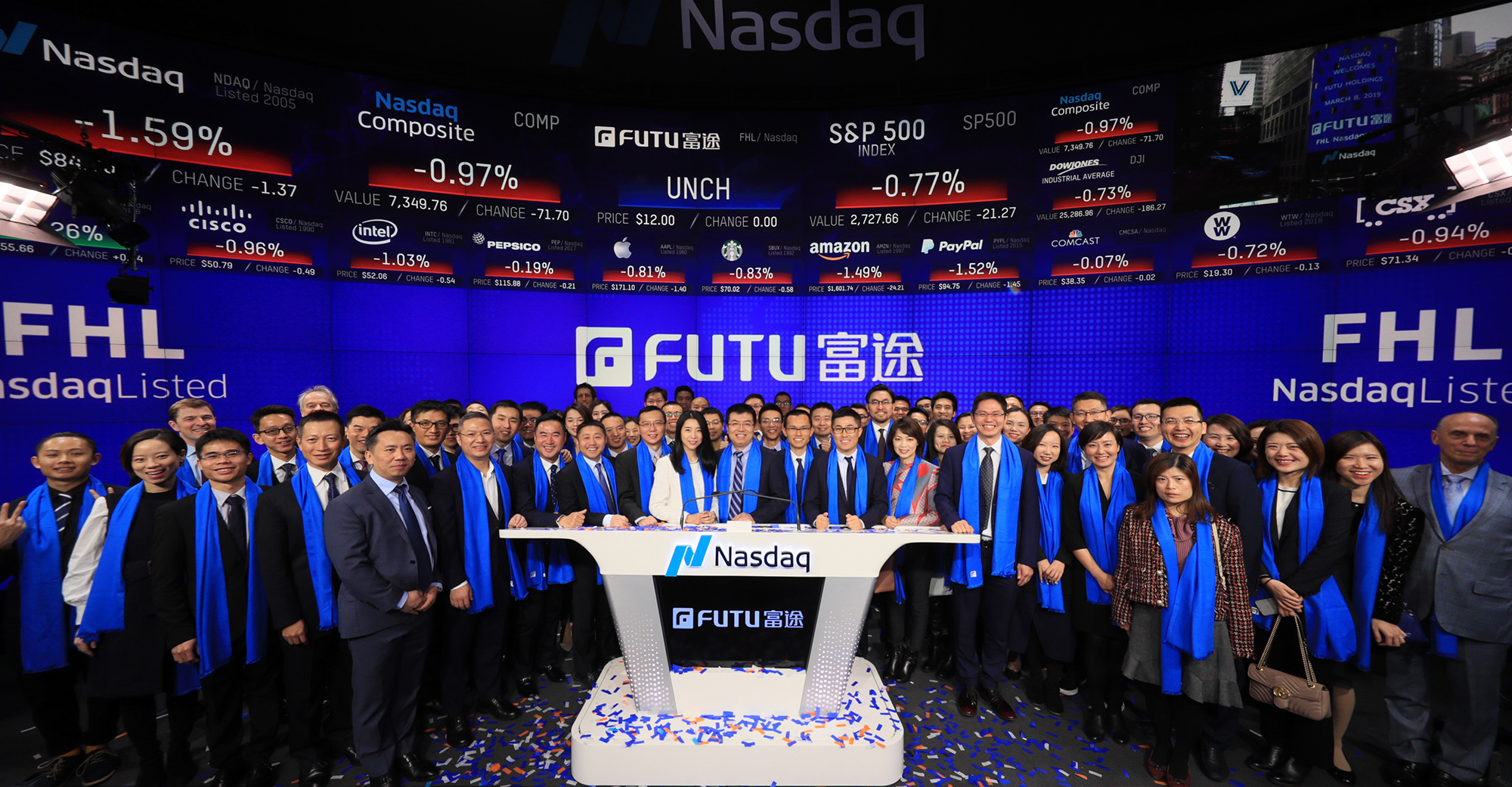

Futu Holdings Limited Sponsored ADR (NASDAQ: FUTU) has carved a niche for itself in the highly competitive online brokerage industry. It is a company that prides itself on its advanced digital financial services and user-friendly trading platform, which have helped it stand its ground against industry titans such as Robinhood and Charles Schwab. Futu’s primary strength lies in its diverse range of investment tools and services, which are meticulously tailored to meet the various needs of different investors.

Citigroup’s Optimistic View on Futu

On November 21, 2025, Citigroup upped FUTU’s stock to a “Buy” rating following a recent selloff, setting the stock price at approximately $157.67. As reported by TheFly, this upgrade is a clear indication of Citigroup’s bullish sentiment towards Futu Holdings. At present, the stock is valued at $157.29, showcasing a 2.28% uptick, with recent price movements fluctuating between $154 and $159.20.

Collective Positive Analyst Ratings and Price Targets

Collectively, Futu has earned an average “Buy” rating from ten analysts. This includes two analysts maintaining a neutral stance, six recommending a buy, and two advocating for a strong buy. The consensus 12-month price target stands at a robust $203. Bank of America has increased its price target from $172 to $200, maintaining a “buy” rating. On the other hand, DBS Bank has shifted its stance to a “moderate buy.”

Daiwa Capital Markets has also recently commenced coverage on Futu, attaching a “buy” rating and a target price of $190. The stock has shown considerable movement over the past year, achieving a 52-week peak of $202.53 and dipping to a low of $70.60.

Futu’s Strong Market Presence

With a market capitalization nearing $21.9 billion and a trading volume of 987,259 shares, Futu exhibits significant investor engagement and market presence. These stats demonstrate the confidence investors and the market at large have in Futu’s growth trajectory. The company’s innovative platform and its competitiveness within the online brokerage sphere further highlight its potential for a promising future.

Looking Forward

The overall positive analyst ratings and ambitious price targets underscore the overall market’s confidence in Futu’s growth trajectory. As the company continues to innovate and expand its service offerings, it solidifies its position as a noteworthy stock to watch in the financial domain. Futu’s robust digital financial services and user-friendly trading platform have positioned the company as a strong contender in the online brokerage industry, making it a potential high-yield investment for investors looking for dynamic growth opportunities in the financial sector.