Source: Davit Kirakosyan

Intuitive Surgical Exceeds Wall Street Predictions for Q2

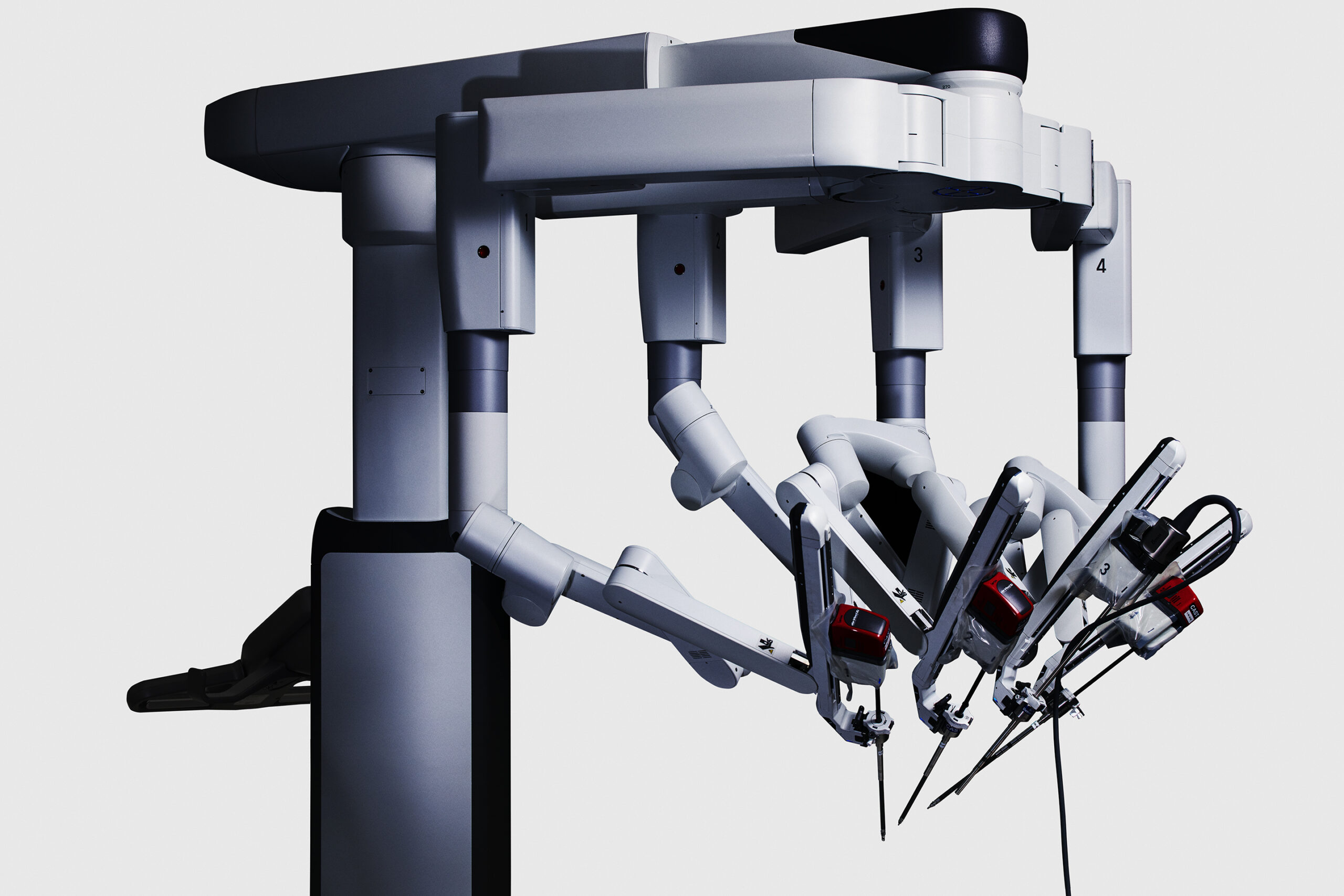

Intuitive Surgical (NASDAQ:ISRG), the manufacturer of the renowned da Vinci robotic surgical systems, recently reported impressive second-quarter results that surpassed Wall Street predictions on both revenue and earnings. The company’s strong performance reflected in its adjusted earnings of $2.19 per share, which outperformed the $1.93 consensus and marked a significant improvement from the $1.78 reported a year earlier.

The company’s revenue also saw a notable increase, jumping 21% year-over-year to reach $2.44 billion, thereby surpassing the estimated $2.35 billion. This significant surge in revenue underscores the company’s dynamic growth strategy and robust market demand for its innovative medical technology.

Lowered Gross Margin Forecast Despite Strong Topline Growth

Despite the solid topline growth, Intuitive Surgical made a surprising move by lowering its 2025 non-GAAP gross margin forecast. The company reduced its gross margin outlook to 66%-67%, a considerable drop from 69.1% in 2024.

The management pointed to a 1% revenue drag brought about by international tariffs and an increase in depreciation tied to recent infrastructure investments as the primary reasons for this downward adjustment. This decision underlines the company’s strategic approach to balancing growth and profitability while navigating a complex global economic landscape.

Intuitive’s Future Outlook Amid Macroeconomic Pressures

As the company looks to the future, it has set a growth forecast for da Vinci procedures at 15.5% to 17% for the current year. This projection is slightly lower than the 17% rate achieved in 2024.

The company’s operating expenses are also expected to rise by up to 14% as it continues to channel investments towards innovation. This decision comes amidst broader macroeconomic pressures that have affected industries worldwide. Despite these challenges, the company remains steadfast in its commitment to push the boundaries of medical technology, a commitment that has been the hallmark of its success.

Investing in Innovation Amid Economic Challenges

The increase in operating expenses reflects Intuitive Surgical’s dedication to maintaining its position as a pioneer in the industry. The company is known for its advancements in minimally invasive care, particularly through its da Vinci robotic surgical systems.

By continuing to invest in research and development, the company aims to remain at the forefront of the industry, delivering innovative solutions that enhance patient outcomes and streamline surgical procedures. However, the company’s focus on innovation also means it must navigate an environment of rising costs and economic uncertainty.

Conclusion

In conclusion, Intuitive Surgical’s strong second-quarter results demonstrate its resilience and ability to outperform Wall Street’s expectations, even amidst challenging economic conditions. Despite lowering its gross margin forecast due to international tariffs and higher depreciation costs, the company remains committed to investing in innovation and driving growth.

The company’s strategic decisions reflect its deep understanding of the industry and its commitment to providing high-quality, innovative solutions. As the company continues to advance its technology and propel the industry forward, it remains a compelling player in the medical technology sector.

However, as with any business operating in today’s volatile economic environment, Intuitive Surgical must continue to adapt and evolve to maintain its competitive edge. The company’s future performance will be influenced by its ability to navigate these challenges while continuing to drive innovation and growth.